Global Aerospace's Annual Jetstream Publication Offers Insights on Airport Capacity as Global Demand for Air Travel Surges

Balancing In-Air Advancements With On-the-Ground Realities

Morris Plains, NJ, Feb. 10, 2026 (GLOBE NEWSWIRE) --

If you have flown recently, it is likely that you have faced delayed or even cancelled flights. This trend has caught the attention of the media and resulted in widespread reporting of deficiencies in the world’s air traffic systems and the need for modernisation to increase capacity and ensure safety.

The reality of the situation is that global air traffic has exploded since the 1970s and our current systems have struggled to keep pace.

1970 to Today: Global Demand for Air Travel Surges

Over the last 50+ years, air traffic has increased dramatically worldwide.

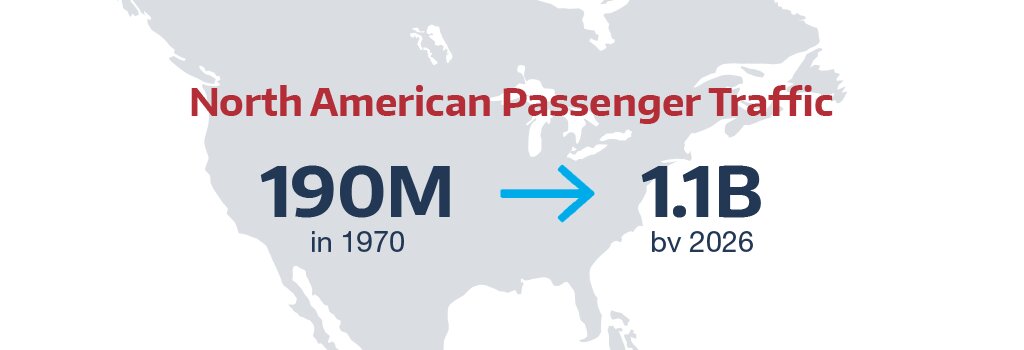

North America

Airline traffic in North America has expanded dramatically since the 1970s, driven by regulatory reforms, economic growth and technological advancements. In the United States, airlines carried about 172 million passengers in 1970.

The Airline Deregulation Act of 1978 triggered a surge in competition and connectivity, making air travel more affordable and accessible.

By 2019, U.S. airlines carried approximately 926 million passengers, up more than fivefold from 1970.

Canada has followed a similar trajectory, with total air passenger traffic growing from about 18 million in 1970 to over 159 million in 2019, according to Transport Canada.

The COVID-19 pandemic caused historic decline, but both nations are now rebounding strongly.

As of 2023, North American passenger traffic had recovered to over 90% of pre-pandemic levels and is projected to surpass 1.1 billion annual passengers by 2026.

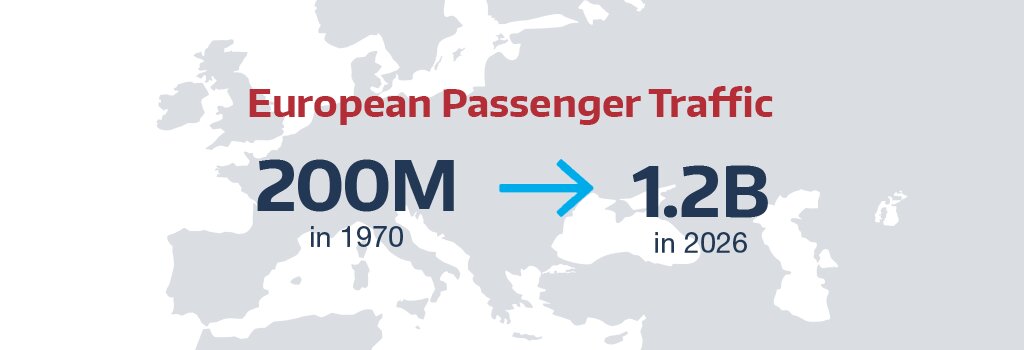

Europe

In 1970, air traffic across Europe was still limited and expensive, with around 200 million passengers across the continent.

Liberalisation in the 1990s—especially the creation of the European Single Aviation Market in 1992—transformed the landscape, enabling carriers to operate freely across EU countries. This led to the rise of low-cost giants such as Ryanair and easyJet.

By 2010, total passenger numbers in Europe had reached 793 million, and by 2019, traffic peaked at approximately 1.2 billion passengers, according to Eurostat.

Key hubs like London Heathrow, Frankfurt and Paris Charles de Gaulle became some of the busiest in the world.

The COVID-19 crisis caused a 73% drop in European air traffic in 2020.

But by 2023, traffic had rebounded to about 85% of pre-pandemic levels, with full recovery expected this year.

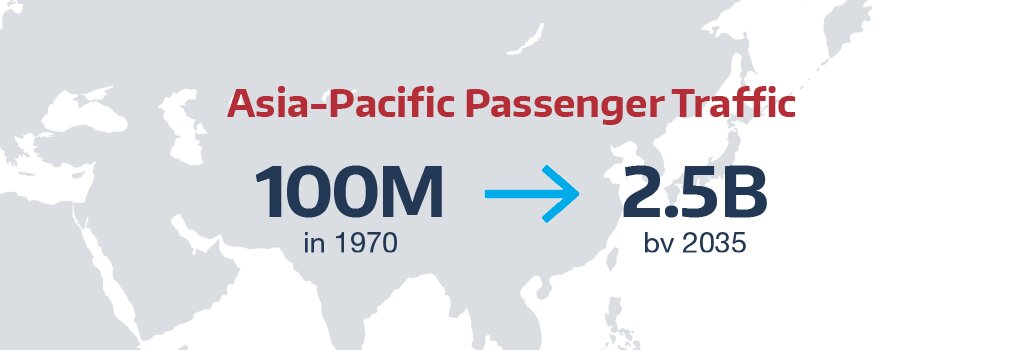

Asia

Asia’s air traffic has grown the fastest of any region since the 1970s. In 1970, Asia-Pacific airlines carried fewer than 100 million passengers, but rapid economic development, urbanisation and middle-class growth dramatically changed this.

By 2000, traffic reached around 370 million, and by 2019, the region handled more than 1.6 billion passengers, overtaking North America and Europe to become the largest air travel market in the world.

China alone saw exponential growth—rising from 6 million passengers in 1980 to 660 million in 2019.

India also expanded from around 10 million in 1990 to over 170 million in 2019.

The pandemic hit Asia particularly hard, with strict travel restrictions reducing traffic by more than 80% in 2020.

However, with China and other major markets reopening fully by 2023–2024, International Air Transport Association projects Asia-Pacific passenger numbers will surpass 2.5 billion annually by 2035, reaffirming the region’s long-term dominance.

Bracing for Significant Global Growth

Over the next 30 years, global airline passenger demand is expected to increase significantly, driven by population growth, rising incomes in emerging markets, urbanisation and increasing globalisation.

According to the International Air Transport Association (IATA), the number of annual air passengers is projected to double from around 4.5 billion in 2019 to over 9.4 billion by 2050.

The strongest growth will come from the Asia-Pacific region, particularly China, India and Southeast Asia, where expanding middle classes and infrastructure investments are fuelling demand.

Africa is also expected to see rapid growth, albeit from a smaller base, with annual passenger numbers forecast to increase fivefold by 2050.

What Has Been Done To Increase System Capacity?

Despite recent reporting which might leave one with the impression that nothing has been done to modernise the global air traffic system, there have been significant advancements in recent years.

Satellite-Based Navigation & GNSS

Systems like GPS, WAAS (Wide Area Augmentation System) and EGNOS (European Geostationary Navigation Overlay Service) have enabled high-precision navigation. These technologies support closer spacing on en-route and approach paths—reducing buffer zones required with older ground-based navigation aids.

ADS-B (Automatic Dependent Surveillance–Broadcast)

This technology has increased situational awareness and, in some cases, replaces radar with GPS-based surveillance. ADS-B enables more precise aircraft tracking, tighter spacing and better routing.

Data communications (Data Comm)

In some situations, such as pre-departure clearances, this technology has replaced voice instructions with digital text communication between pilots and ATC. Data Comm speeds up clearances and reduces miscommunication.

Reduced Vertical Separation Minimum (RVSM)

This creates more usable flight levels from 29,000 to 41,000. Prior to its introduction, aircraft were separated by 2,000 feet. Through the standardisation of technology required in aircraft, this separation requirement was reduced to 1,000 feet, essentially doubling the capacity in cruise flight.

Mode S transponders

These devices provide detailed aircraft information (altitude, position, speed, ID) which supports improved conflict detection and aircraft separation.

Wake Turbulence Re-Categorisation (RECAT)

This initiative is being implemented in Europe and North America to reduce how closely aircraft can follow each other based on a better understanding of the wake turbulence characteristics of aircraft.

All of the above individual technologies have laid the foundation for some recent integrated solutions to increase airspace capacity. EUROCONTROL has recently rolled out Free Route Airspace (FRA) & Dynamic Airspace Management. Under this system, aircraft are no longer confined to fixed airways and can fly direct routes across open airspace with designated exit and entry points at departure and destination airports.

Both the FAA and EUROCONTROL have implemented Traffic Flow Management (TFM) Systems. These systems integrate weather, traffic and operational data to manage en-route and airport traffic flow proactively. The best way to understand this is that traffic controllers direct individual aircraft while traffic flow managers strategically looks at the flow of the entire system to optimise capacity.

It is expected that AI will play a growing role in this space in the coming years.

The remaining work to be done on air traffic systems, and the heaviest lift to be sure, largely focuses on the ground-based infrastructure of air traffic systems. The world’s current system for communications and radar surveillance is largely analog-based systems that date back decades. Some work has been done to modernise, but much still remains.

The Missing Link: Sufficient Runways To Support Rapid Growth

One element of the air traffic system is often overlooked but essential. In fact, this aspect might be the most critical variable when it comes to system capacity. Still it is often left out of discussions of ATC modernisation, and it may be the hardest variable to change. That variable is runways, more specifically building new runways to match demand growth.

Think of the transition from cruise altitude to landing as a funnel. During cruise flight the spacing between aircraft is at its greatest. As aircraft descend towards the airport environment, they operate in closer proximity to each other. All of the in-air advancements discussed above have enabled us to reduce aircraft separation in the air safely over the years.

As aircraft land, they all must cross the 150-foot-wide end of a runway just prior to touchdown—this is the end of the funnel. If you stand at a busy airport and watch landing aircraft, you will note that as one completes its landing roll and turns off the runway, another aircraft is just about to touch down. This ultimately defines system capacity. When operations look like this, which they normally do at busy airports, you cannot add more aircraft to the system without incurring delays.

The irony is, as much as we improve technology in the air to reduce aircraft separation standards, they all must work their way through the funnel to the end of a runway. You may have noticed that new runways are not built very often.

The existing airport infrastructure in many regions of the world, such as Europe and North America was established in the 1960s and 1970s.

These airports were built in or near cities and often urban sprawl has enveloped them leaving few options for expansion. The three main airports in the New York City metro area, Kennedy, Newark and LaGuardia are surrounded by urban sprawl, and/or water, leaving few options, if any, for runway expansion.

London’s Heathrow airport is a prime example of the NIMBY mindset—not in my back yard. Original plans for a third runway at Heathrow were first envisioned in 2006. The project has been on and off multiple times due to multiple judicial rulings over the years. At the moment, it appears the project will move forward with an estimated completion within a decade. Clean sheet new airports face similar challenges.

There are only a few examples of new construction airports in North America and Europe in recent decades. New airport development is taking place in other regions of the world, such as China which has invested heavily in new airport infrastructure.

In Focus: U.S. Passenger Enplanements and Airport Capacity

To illustrate the problem, one can look at airport infrastructure in the United States as an example. There are 37 “Class Bravo” airports there. These are the nation’s busiest, and they handle, by some estimations, greater than 70% of U.S. passenger enplanements.

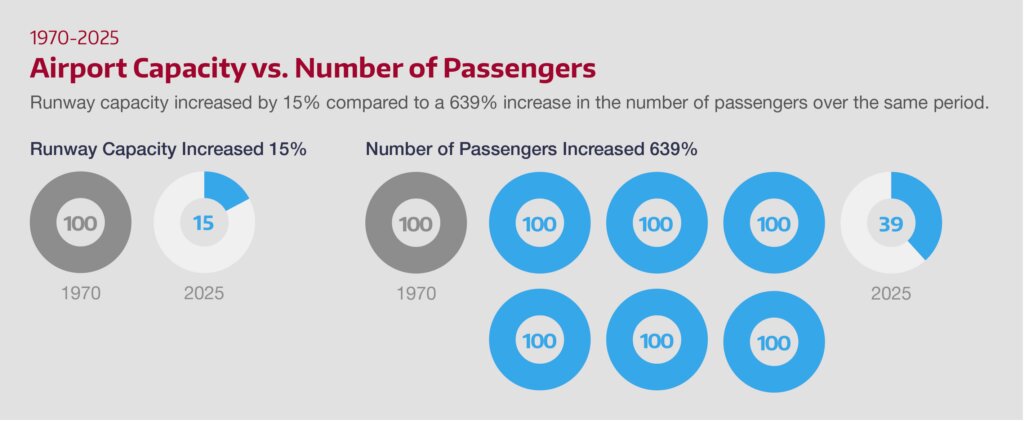

Together, they have 129 runways in operation today. In 1970, these airports had 112 runways.

That is an increase in runways of 15% against an increase in passenger enplanements of 639% in the same period. Of these 37 airports, only two were constructed post-1970.

The current Denver airport, opened in 1995, replaced an existing one. The new airport, however, had the same number of runways (six) as the airport being closed. It does have a more efficient runway layout and room for future expansion. Kansas City International Airport (originally Mid-Continent International Airport) did replace an older one, but because of the dramatic expansion, it could be thought of as a new airport and not a replacement.

Despite the challenges associated with new airport development, there are some examples of well-executed new airport projects. The new Istanbul airport is one such example. Construction began in May 2015, and the airport opened in October 2018. Airline operations were transferred from the older Ataturk airport in April of 2019.

The new airport was the second busiest in Europe (Heathrow being the first) and the seventh busiest in the world in 2024, serving 80 million passengers. Sitting at the crossroads of Europe and Asia, the new airport is now the most internationally connected airport in the world, with direct flights to 310 destinations. As of today the airport is only partially completed, with ultimate completion scheduled for 2027, and an anticipated capacity of 150 million annual passengers.

Final Thoughts

If the world’s aerospace infrastructure is going to keep pace with anticipated growth, more attention needs to be paid to the development of new airports, expanded use of underutilised airports and new runways at existing airports.

There are multiple challenges to overcome, including regulations, NIMBY and the cost of development, among other things.

However, the current struggles with delays and cancelled flights will only become worse if the current gap between demand and available runways continues to grow.

Read Full Jetstream Publication

About Global Aerospace

Global Aerospace has a century of experience and powerful passion for providing aviation insurance solutions that protect industry stakeholders and empower the industry to thrive. With financial stability from a pool of the world’s foremost capital, we leverage innovative ideas, advanced technology and a powerful synergy among diverse team members to underwrite and process claims for the many risks our clients face. Headquartered in the UK, we have offices in Canada, France, Germany and throughout the United States. Learn more at https://www.global-aero.com/

Global Aerospace Media Contact

Suzanne Keneally

Vice President, Group Head of Communications

+1 973-490-8588

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.